Tally is a powerful accounting package and a key Tally Accounting career option in the current business world. Business accountants with Tally with GST: After the introduction of GST (Goods and Services Tax) in India, businesses now need accountants to be proficient in Tally with GST so as to ensure accurate financial reporting and compliance. Prospects & Benefits of Learning Tally with GST. Whether you are a student for pursuing an entrepreneurship or a working professional, learning Tally with GST can lead to multiple lucrative career opportunities!

In this blog, we will discuss the importance of a Tally with GST Course, its benefits, and how you can learn accounting practically to deal with real-life business transactions.

What is Tally Accounting?

Tally Accounting-Most widely used Accounting Software for SMBs. The application is renowned for its ease of use and powerful features that enable businesses to keep track of their accounting records, taxes, payroll, and inventory seamlessly. Tally with GST making GST compliance seamless, and gives you a hassle-free experience of tax filing.

Features of Tally Accounting:

• Account & Book: Handle financial transactions, ledgers and journals.

• GST Compliant: Create GST invoices, run GST returns, and file GST returns easily.

• Inventory Management: Keep track of stock levels, purchase orders, and sales.

• Payroll Processing: Streamline and automate salary computations, deductions, allowances, and employee records.

• Bank Reconciliation: Track bank transactions very accurately.

Why Learn Tally with GST?

Considering the increased requirements of GST-compliant accounting, GST really gives professionals a competitive advantage so get yourself trained in Tally with GST. The following are significant motives to pursue a Tally with GST Course:

Tally-be worked within the high Demand

As organizations structure everything around GST, organizations are currently looking for qualified accountants proficient in Tally Accounting to deal with GST calculations, invoices, and productivity tax returns.

Better Career Opportunities

Here are While this is the typical career progression in Tally Accounting.

• Accountant

• GST Consultant

• Tally Operator

• Tax Analyst

• Accounts Executive

Technical Skills: Practical Knowledge of Book-keeping

A Tally with GST Course provides practical knowledge, as opposed to theoretical learning. This is important to learn:

• Auditing and regulating ledger management

• Recording transactions in bookkeeping as per GST rules

• Filing GST returns

• Slices that building a financial report for strategic decision making

• No business life can run without it.

• Tally with GST for business owners has increased financial control, accurate tax filing and seamless operation of business.

Key Takeaways from a Tally with GST Course

As a new learner or professional course for Tally with GST is intended to use practical accounting skills. Some of the key areas this covers are:

• Basics of Tally Accounting

• [Tally ERP 9 / Tally Prime Introduction]

• Interpreting financial statements (P&L, Balance Sheet)

• Creating and managing ledgers

• GST Implementation in Tally

• Setting up GST in Tally

• Invoicing in GST compliant manner

• To record the sales and purchase under the GST

• Filing of GSTR-1, GSTR-3B, and GSTR-9

• Management and valuation of stock

• Use of Bill of Materials (BOM) and different GST rates

• Setup of payroll and pay run processing

• Financial Reporting and Bank Reconciliation

• Tally automation in bank transactions

• Reports generation for tax compliance

• Examining business performance using financial statements

Which is The Best Tally with GST Course?

In the abundance of choices, choosing a proper one for Tally with GST Course can alter the entire learning experience. Here’s what to look for:

Practical Learning Approach:

Look for a course that has practical exposure through real-life case studies and GST situations.

Certification:

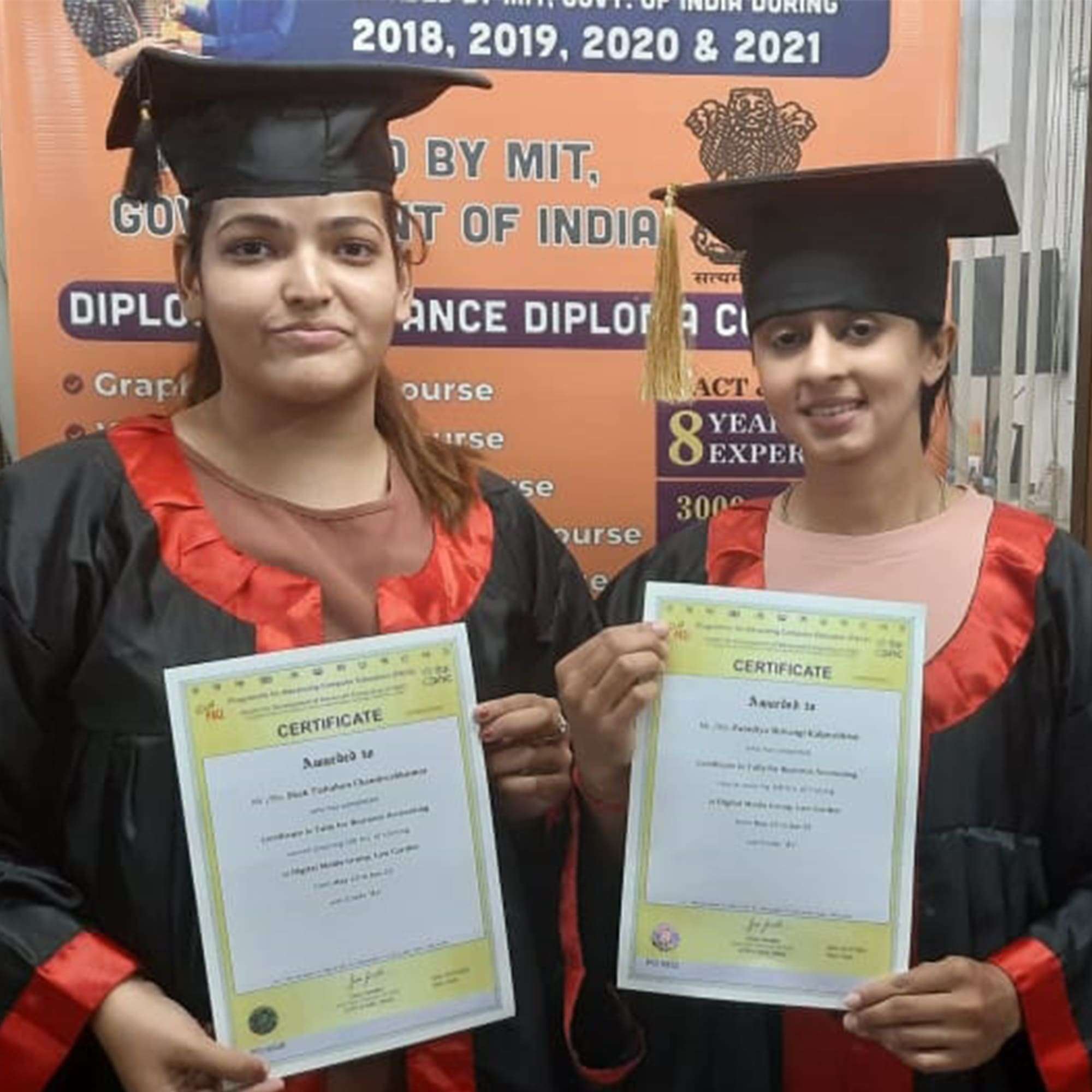

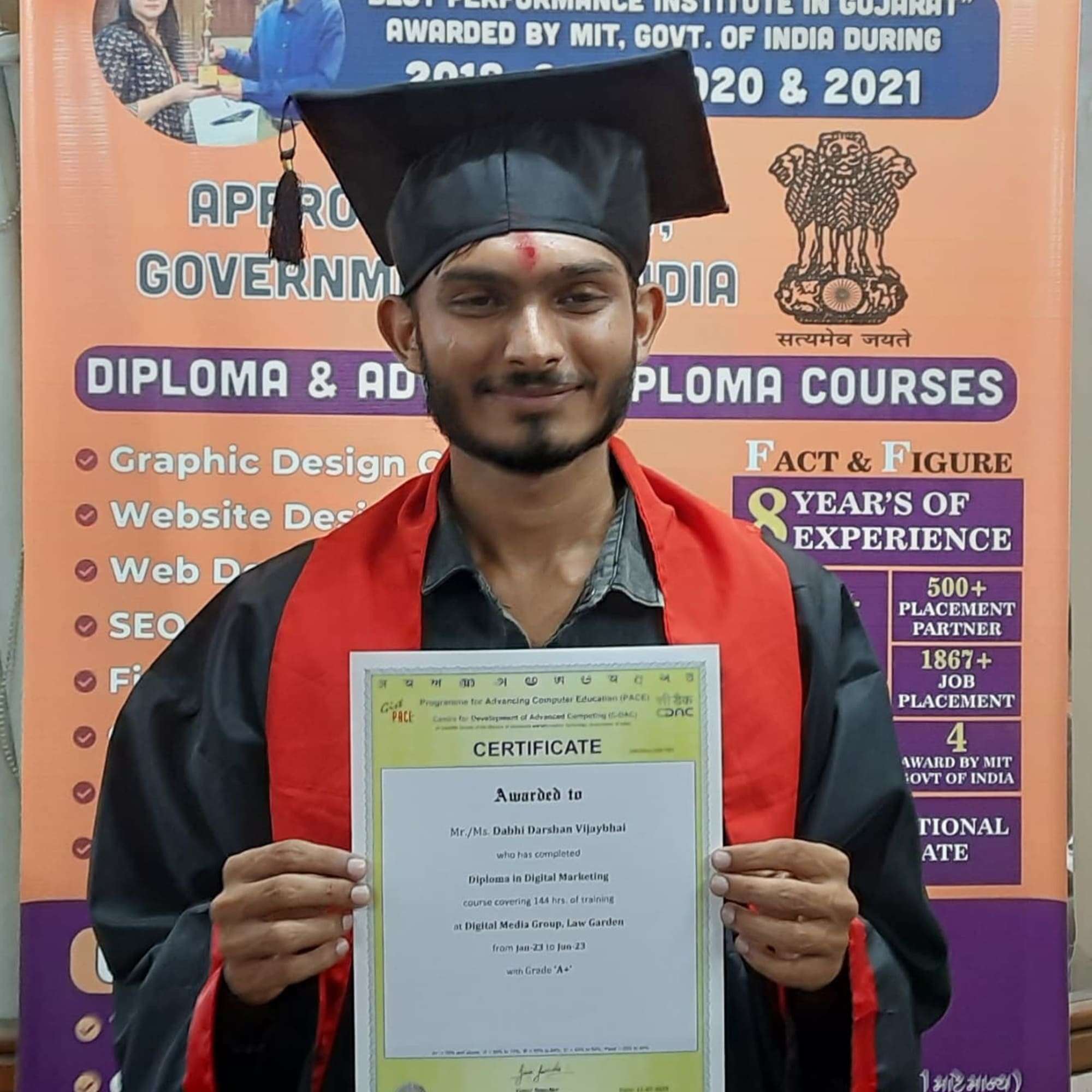

Having a certified Tally Account is always an added advantage in your resume and in getting jobs as well.

Expert Instructors:

Select classes with teachers who have had real business experience.

Job Assistance:

Few institutes will give you placement support as well to land a job in Tally Accounting.

Tally accounting career opportunities:

With such high demand, a career in Tally Accounting is rewarding, as opportunities can be found in sectors like retail, manufacturing, finance, and consultancy. Here’s a peek at what a few potential career paths look like:

Conclusion

Torrent with GST Course is a great investment for anyone seeking a successful Tally Accounting career. As a Student, Accountant, or Business Owner, mastering Tally with GST will ensure your presence in the competitive job market and smooth running of businesses financial operations which is the demand of the current job market.

So, what are you waiting for; jump on board and develop functional accounting skills valuable to the commercial world!